Capital is always the fueling factor for any business. Every business journey eventually reaches a point where business loans become necessary. When an owner thinks about taking a loan, they research extensively because there are many loan scammers in the market. Even if you find a trusted lender, you must carefully consider the risks, interest rates, and your repayment ability. Let me share the knowledge I have about high-risk business loans—their pros and cons, and how they can impact your business.

This write-up will cover the following key points:

- Why a Halloween party loan is important during this festive season

- The different types of loans you can choose from

- Whether a business loan is possible with no credit check

- The process and eligibility criteria for getting a business loan

What Are High-Risk Business Loans?

A high-risk business loan is a type of loan designed for borrowers who don’t meet the typical requirements of traditional lenders, often due to financial challenges. Their traditional risk metrics may be weak, insufficient, or inconsistent. These metrics could include:

- Low credit scores (often below 600)

- Limited financial history

- Irregular income or cash flow

- Past defaults or bankruptcies

Who Offers High-Risk Business Loans Online?

High risk loans are offered by online direct lenders such as us, BusinessAdvanceLender. We operate directly without third parties and don’t rely on traditional credit metrics. Our loans come with several benefits and also include several risk factors. Borrowers who can manage the risks responsibly are well-suited for these loans.

Direct Lender Business Loans Includes:

- Small Business Loans

- Working Capital Loans

- Long Term Business Loans

- Unsecured Business Loans

Understanding High-Risk Business Loan Interest Rates

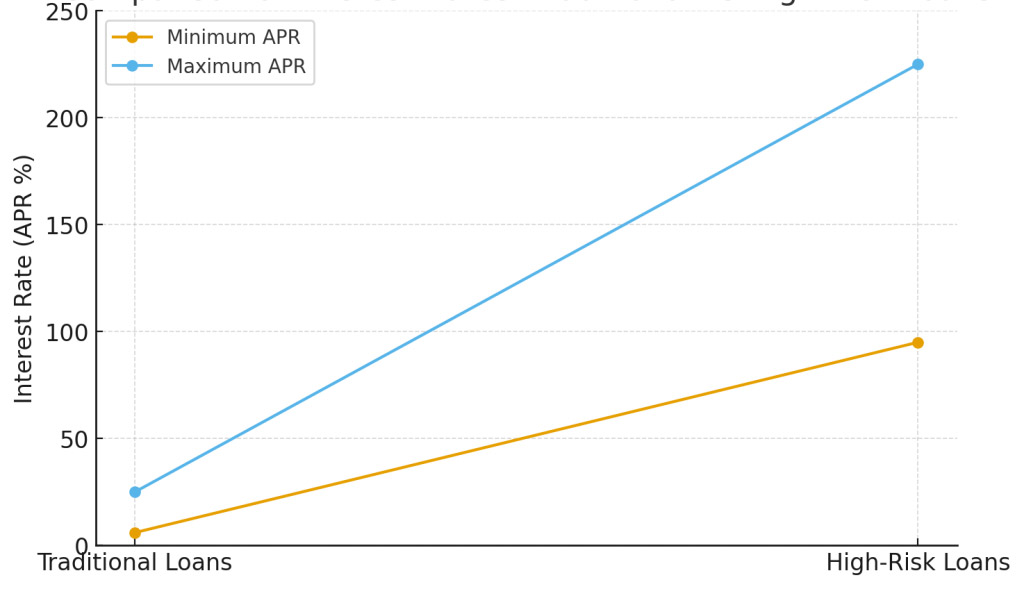

Traditional business loans typically run at 6–25% APR (depending on credit and collateral). In contrast, high-risk business loans may range from 95–225%, or more.

Comparison of Interest Rates: Traditional vs High-Risk Loans

While these loans come with higher interest rates, they provide quick access to cash, which can be crucial during business emergencies when waiting for traditional loans could take days.

High-risk business loans carry higher risk and rates, but they also offer several advantages: fast funding, opportunities for businesses to rebuild credit, and a second chance for borrowers who might otherwise be denied by conventional lenders.

Pros and Cons of High Risk Business Loans

Pros:

- Quick funding for urgent business needs

- Flexible repayment options

- Provides a second chance to rebuild your credit score

- Does not require collateral

Cons:

- High cost due to interest and fees

- Missed payments can lead to additional debt

- Business must generate at least $1,500 in monthly sales

Is a High-Risk Business Loan Right for You?

These loans are well-suited for various types of business owners who may not qualify for traditional financing. They’re an ideal option if you meet any of the following criteria:

- Borrowers with low or no credit

- Small business owners needing quick working capital

- Individuals facing unexpected expenses

- Entrepreneurs with limited access to traditional financing

How to Apply for a High-Risk Business Loan

Step 1: Complete the Online Application

Fill out the application form with your basic contact details—such as your name, phone number, email address—and the amount you wish to request.

Step 2: Submit Following Documents

- Bank statements (last 3–6 months)

- Proof of business revenue

- Valid ID or SSN

- Active business bank account

Step 3: Get Approved & Funded

Once approved, funds are deposited directly into your account—often within the same day. High-risk business loans can be a powerful tool when used responsibly. At BusinessAdvanceLenders.com, we believe in empowering borrowers with fast, flexible funding and clear terms. High risk business loans give you an opportunity to rebuild credit, expand a business, and handle a financial emergency. Transparency matters most in high-risk lending—always ensure you fully understand the terms before signing